The easiest means to find the best well-rounded remedy is to make usage of innovative wise innovation like Jerry to help you locate a rideshare insurance policy package that deals with your demands and budget. "I can not overcome just how very easy the procedure of looking for more affordable insurance coverage was with Jerry! I have a clean driving record as well as could not comprehend why my insurance expenses maintained rising - cheaper car.

Neither the rideshare business insurance plan nor your typical plan will completely cover you throughout the period where you are on the work but have not yet Click for info approved a ride or delivery request. Also if you are involved in a crash in among the periods that is totally covered by the common Uber or Lyft business insurance plan as well as you require to submit a claim, you will likely be in charge of paying a $2500 deductible - suvs.

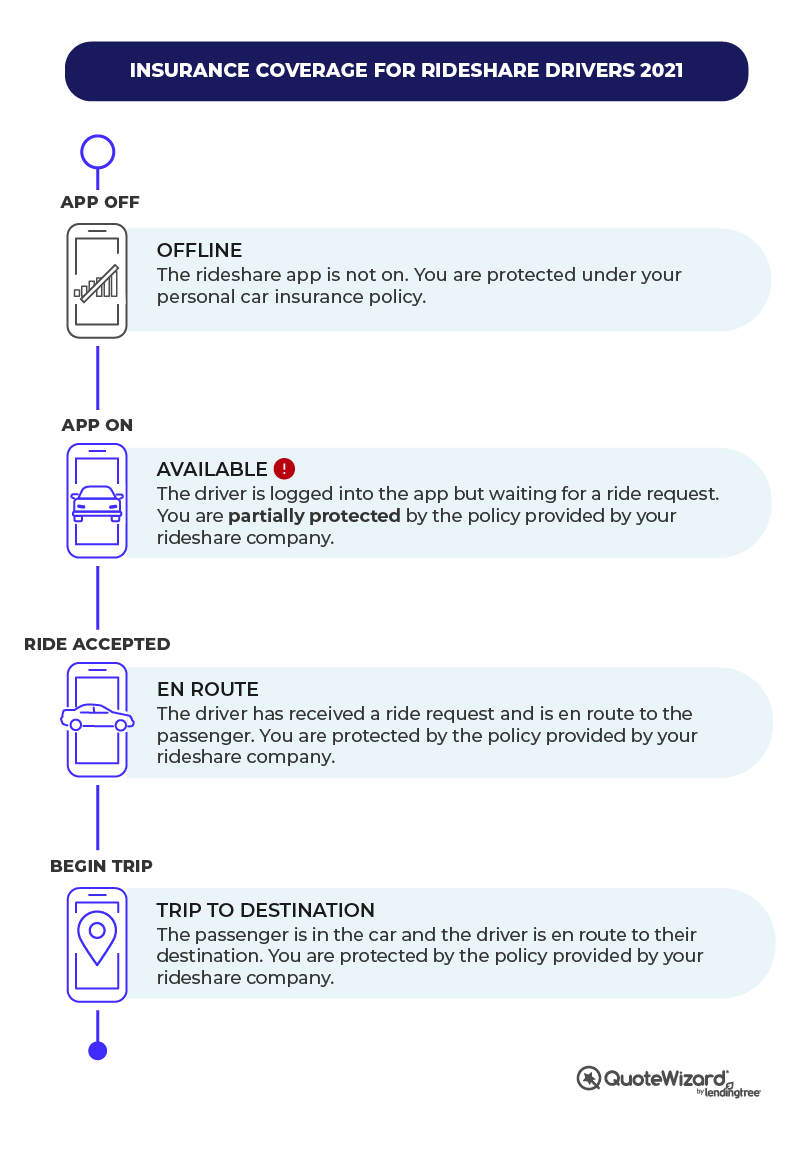

Uber and Lyft insurance policy by duration In the instance of Uber or Lyft, the firm insurance plan either kicks in or does not start according to a marked period of the ride that you are in the procedure of completing. The system works as adheres to: This period covers any type of time when the rideshare application is not activated. risks.

This duration describes the certain period where your application is switched on however you are still waiting on or haven't yet accepted a customer demand. car. This is the space period where you are not covered by your common personal insurance plan or the rideshare app plan. If your business insurance coverage supplies protection at this factor, it will be very restricted.

As soon as you accept a trip demand and also head out towards your collection location, your rideshare business insurance coverage policy will completely come right into effect. cheap insurance. Once you grab a guest and also have them in your vehicle, you are still totally covered by your rideshare company's insurance plan till the trip is significant full.

Fascination About Rideshare Insurance North Carolina - Insurance For Uber & Lyft

This is where rideshare insurance covers the gaps. You will certainly be covered by the very same regularly solid policy regardless of whether you get on or off the task at any type of particular time. Shipment solution insurance by period If you are driving for a delivery app solution, it's important that you take some time to have a look at your company auto insurance coverage to discover out exactly what you are covered for and what isn't covered.

During this duration, you will certainly be covered by your personal insurance plan. This duration describes the details time period where your app is switched on but you are still waiting on or haven't yet accepted a distribution request. During this gap period, you may not be covered by either your standard individual insurance coverage or the delivery app's policy.

Many drivers will call for a supplemental rideshare insurance plan to make certain they are covered during this in-between period. insurance. Unlike Uber or Lyft, not all distribution app business will certainly supply you with firm insurance coverage when you are driving to pick up a delivery however have not gotten the product. In many cases, when you accept a demand and head out toward your set destination, your distribution application company insurance plan will completely or partially entered result.

Nevertheless, if your firm does not offer insurance coverage, you will certainly be left prone must you be entailed in an accident while delivering a product. As you can see from above, several shipment application chauffeurs can potentially be left uninsured at any duration of the process. auto. At various other times, you could only receive minimal protection by your company insurance coverage if in all.

State Farm rideshare insurance coverage is readily available in almost every state (with a couple of exemptions) and doesn't come with any kind of pesky strings like gas mileage restrictions affixed. If you help both a rideshare service and also delivery application service like Uber, Eats, you can extend your insurance coverage without needing to stress over paying a higher costs (car insurance).

Not known Incorrect Statements About Rideshare Car Insurance Coverage - Finder.com

The Allstate rideshare insurance coverage functions as an add-on to an existing exclusive automobile insurance plan. Primarily, should you be entailed in an accident while in any of the durations covered by your rideshare firm policy, the personal rideshare add-on will certainly help you cover the distinction between the business insurance deductible and also Allstate's much reduced ordinary insurance deductible of concerning $500. car insured.

On the disadvantage, you need to have an existing Allstate car insurance policy in place in order to subscribe and Allstate does not guarantee that you will certainly be covered when you get on the work, so you still might be left susceptible during the void durations while working. Progressive's rideshare insurance policy coverage, The noteworthy feature of Progressive's rideshare insurance plan is that it is one of the most personalized rideshare insurance policy prepares available.

automobile insurance company cheaper car insurance cheap

automobile insurance company cheaper car insurance cheap

As an example, they account for "on" and also "off" periods of the year while taking pleasure in the tranquility of mind of understanding that you will certainly be covered all year without paying too much for your coverage. The drawback to the Modern rideshare strategy is that the rates system is not very transparent as well as it is very individualized, making it challenging to properly evaluate alternatives when you contrast low-cost car insurance coverage quotes.

It is an excellent idea to have the adhering to files handy need to they be needed: Any type of appropriate Rideshare business certification, A duplicate of the Rideshare company regulations, Evidence of your personal insurance policy, While awaiting the cops to show up, ideally, exchange any kind of appropriate info with the other chauffeur. perks. This need to include the following: Legal name, Get in touch with information, Insurance coverage details, Get in touch with your individual insurance policy provider asap.

The topic of insurance policy can be complicated, yet it is very important you recognize just how as well as when our plans cover you and also your passengers in case of an incident. The following is a summary of how our insurance coverage function. Keep in mind: Just one policy applies when the motorist is involved in either Rideshare or Lyft Deliveries Solutions.

Not known Facts About Rideshare Driver Insurance

The coverages use to healthcare or medical expenses if you are hurt in a protected crash. The accessibility of first-party injury coverage as well as the coverage restrictions vary by state.

Note: All policies might be changed to follow details city or state insurance demands - cheaper car insurance. Uninsured/underinsured vehicle driver protection covers injuries to you and your travelers in a protected incident triggered by a vehicle driver who does not have adequate insurance. First-party protection uses to medical care or medical expenses if you are hurt in a protected mishap.

Express Drive tenant's insurance policy coverage depends upon which of the following 3 durations you're in when an incident happens: Individual driving: You're offline (i. e. not in vehicle driver mode)Waiting for a demand: When the app remains in driver mode and also you have actually not obtained a flight demand. auto insurance. Ride in progress: This includes at any time from accepting a trip request till the time the trip has finished in the app.

These insurance coverages are offered in all states in the U.S., with the exception of those rides coming from New york city City with a TLC (Taxi and also Limousine Commission) chauffeur. Some areas might have details requirements that customize the described protection (low cost). We're committed to pressing the insurance policy market to produce innovative solutions for our chauffeurs.

Please call your personal auto insurance firm to discover what plans are readily available to you. In pick areas, Lyft (via Lyft Facility, Inc.) has actually partnered with insurance policy companies to use rideshare insurance plan at discounted rates. cheap. These vehicle plans cover your auto both when you're driving for rideshare, or driving for personal use.

Our Rideshare Insurance: How To Ride The Wave - Agency Height Statements

Secret Takeaways Rideshare insurance coverage covers you when you drive your vehicle to generate income, whether it's a permanent task or a part-time side hustle. If you have a rideshare gig without telling your insurance provider concerning it, they can possibly terminate your coverage for not revealing your cars and truck's company usage.

If you drive for a company like Uber or Lyft, they likely supply some amount of coverage that covers you at the very least a few of the moment, so examine with the firm to discover what coverage they might or might not offer. Rideshare insurance coverage is designed to cover you when your individual insurance coverage and your rideshare business's insurance coverage do not, which is essential if you do not want to be stuck paying for damages out-of-pocket in a crash (insurers).

This commonly includes mosting likely to the supermarket, taking your kids to school, and also other things you do while you aren't functioning. Your personal auto insurance coverage uses to any crash or various other problem that takes place throughout this moment. Period 1Your rideshare app is on, yet you haven't accepted a flight.

credit score insured car vehicle insurance cheap car insurance

credit score insured car vehicle insurance cheap car insurance

If so, they can generally supply you a rideshare recommendation or rider, which indicates they include the insurance coverage onto your present policy (cars). If your current insurance coverage business does not supply rideshare protection, connect to one more business or an insurance representative to obtain a quote on an automobile insurance coverage plan that does offer a motorcyclist for rideshare coverage.

Consult your supplier to see what protection alternatives they have offered for you. Insurance policy via your rideshare work, Numerous rideshare companies supply a minimum of some coverage for you as a chauffeur, but not every one of them provide insurance coverage as well as some just offer partial protection. For instance, Grub, Center as well as Instacart do not supply any type of coverage whatsoever, while Door, Dashboard just provides responsibility protection (cheap car).

Unknown Facts About 10 Best Auto Insurance Companies For Uber And Lyft Drivers ...

That's where Uber insurance comes right into play. cheap insurance. In this blog post, we break down the basics of Uber insurance, consisting of Let's get going. Table Of Contents Many Uber motorists join to drive without doing the proper amount of research study and commonly forget a crucial element of driving for a rideshare firm: insurance policy.

The price of Uber chauffeur insurance is much less than a lot of vehicle drivers would assume, yet it's worth every cent. An extra Uber insurance coverage plan from a personal insurance provider will often cost vehicle drivers between $6 as well as $20 per month. The price of this type of policy will depend upon the protection amounts, the provider of the policy, and also city you're driving in, as well as a variety of other variables.

For the majority of Uber chauffeurs this is not a sensible route to take due to the fact that they can set you back thousands of bucks a year, while a normal rideshare insurance policy prices just hundreds of bucks (auto insurance). If you explore getting an additional policy, yet learn that rideshare insurance isn't available in your state, you may need to examine out a business policy for Uber.

insurance company cheapest car insurance cheapest auto insurance laws

When determining how much you are making when driving, maintain in mind the expenses expenses like gas and insurance (credit). Reviewing the great print of your Uber insurance policy is crucial.

Every city is different, so among the very best sources readily available is other vehicle drivers in your area. Ask around to see how they are covered to give you a better understanding of how your policy accumulates. Looking into readily available alternatives for Uber motorists in your location is a must.

The 2-Minute Rule for What Is Rideshare Insurance? - Bankrate

Rideshare insurance policy has actually come to be increasingly preferred over the last few years with the development of business like Uber and Lyft. If you're benefiting a rideshare business, you'll require special defense that isn't covered under your standard individual automobile policy. Find out exactly how rideshare functions as well as what you can do to make certain you have the best defense for your lorry.

The bright side is that you wouldn't need a different personal vehicle plan considering that a for-hire livery policy can cover you for both business and personal usage. We provide for-hire livery insurance coverage in 38 states. More Information.

But rideshare insurance coverage it's not without its limitations and the automobile insurance policy coverage given can differ in various states.A TNC company's rideshare insurance coverage covers their chauffeurs only when they're transferring a guest client with their app. Were to occur while you serviced a consumer on the clock, you would certainly be covered under their rideshare insurance.